It’s never too soon to plan for the future, especially when you have a child with special needs. There are several important aspects involved in special needs...

Schedule a Consultation Now

Sussan, Greenwald & Wesler >

Sussan, Greenwald & Wesler >

It’s never too soon to plan for the future, especially when you have a child with special needs. There are several important aspects involved in special needs...

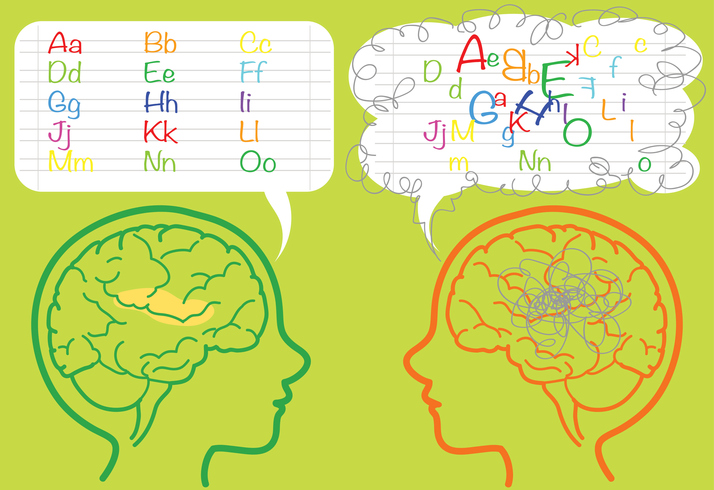

Like people, learning disabilities come in all shapes and sizes. During the month of October each year, the Learning Disabilities Association of America...

If your child has a behavioral issue, you know it. You’ve likely known it for a very long time. When it’s time for school, others are going to learn about it,...

Whether your child with special needs requires care your school district is unable to provide or circumstances have led to a sudden need for out of district...

When you have a child with special needs, you know two things unequivocally: there is nothing you wouldn’t do for your child and IEP/504 Meetings can be...

The New Jersey Board of Education made some changes to the HIB law (Harassment, Intimidation and Bullying – see below for HIB Act details) on July 1, closing...

(This is the third article in our multi-part estate planning series.) If you have a child with special needs, there are countless issues you must...

(This article is part two of a multi-part series: Estate Plan Development for Parents of Children with Special Needs) The basic premise of this article...

It’s never too late to plan for the future when you have a child with disabilities. While it’s easy to feel that the future is far away and there will always...

Every parent wants the very best for their child — whether they are one or 51. Most parents must loosen the reins a bit and allow their kids to take on more...

Turning 18 is a major event from both a social and legal perspective. Most teenagers and their families look forward to 18th birthdays because they represent a new stage of maturity and new opportunities. But for the parents or guardians of young people with...

On Valentine's Day, offer your child your HEART. No, I’m not talking about those funny candy hearts, nor do I refer to a store-bought card. No, your HEART is something far more valuable. It’s you, your presence, your understanding, and your unwavering commitment to...

How much could the Working Families Tax Cut Act of 2025 save you? Last month we introduced the legislation and Trump Accounts for Newborns. This month, we're cutting through the complexity to show you the specific provisions that could lower your tax bill. Here’s a...

When you think about securing the future of your loved ones, estate planning should immediately come to mind. Having the right estate documents written correctly and strategically, and regularly updating them, is the best way to make sure your family has stable...

The holidays are over. Decorations are put away. New Year’s resolutions are already fading, and the cold reality of winter has set in. For students with specials needs, that cold reality may begin with post-holiday regression upon their return to school. After the...